carbon-1.ru

News

Top Rated Financial Planning Firms

Look at the Forbes or Barron's best of rankings for top independent investment advisors. Nearly all will give you a free consultation, but they. They are great how-to aides for people who want to start index investing. Also check out this personal finance reading guide. Learning about and doing some. Below, you can find detailed lists of the top financial advisors within cities and across states. In each review, we've laid out everything you need to know. Vancouver financial planner / financial advisor providing award-winning financial advice with a focus on tax efficiency. Top-rated on Google. Edelman Financial Engines offers investing and financial planning services, wealth management, retirement planning, and more. Joining NAPFA was one of the best decisions I made as a financial planner as it has helped me find a community of like-minded individuals committed to the cause. Charles Zhang, CFP®, was ranked #1 in 20on Barron's list of America's Top Independent Wealth Advisors and has placed in the top 2 on the list. 5 Best Financial Advisors Services in Toronto With Amazing Reviews · Frontwater Capital · Kerr Financial Group · Stewart & Kett Financial Advisors Inc · Caring. Joining NAPFA was one of the best decisions I made as a financial planner as it has helped me find a community of like-minded individuals committed to the cause. Look at the Forbes or Barron's best of rankings for top independent investment advisors. Nearly all will give you a free consultation, but they. They are great how-to aides for people who want to start index investing. Also check out this personal finance reading guide. Learning about and doing some. Below, you can find detailed lists of the top financial advisors within cities and across states. In each review, we've laid out everything you need to know. Vancouver financial planner / financial advisor providing award-winning financial advice with a focus on tax efficiency. Top-rated on Google. Edelman Financial Engines offers investing and financial planning services, wealth management, retirement planning, and more. Joining NAPFA was one of the best decisions I made as a financial planner as it has helped me find a community of like-minded individuals committed to the cause. Charles Zhang, CFP®, was ranked #1 in 20on Barron's list of America's Top Independent Wealth Advisors and has placed in the top 2 on the list. 5 Best Financial Advisors Services in Toronto With Amazing Reviews · Frontwater Capital · Kerr Financial Group · Stewart & Kett Financial Advisors Inc · Caring. Joining NAPFA was one of the best decisions I made as a financial planner as it has helped me find a community of like-minded individuals committed to the cause.

There are two types of professional financial planners included in this tool: QAFP Professionals; CFP Professionals. Image 1. QAFP® Professionals. Qualified. A snapshot of the leading advisers across the US market and the client bases they serve. Plus: we explore why the industry is still struggling to overcome a. Best Financial Advisors and Professionals in Canada | Hot List · Aaron Walker-Duncan Vice President, Board and Communication Services · Alistair Almeida. At TD Wealth, our financial planners can help you create a comprehensive financial plan to help achieve your best life today and tomorrow. Ben Jones, founder of Wave Wealth Management, is known for his service-based, high-touch approach to financial planning and wealth management. We are a fee-only Personal Wealth Management Firm based in Toronto and Montreal that offers family office services, financial advisory, wealth management. CJM Wealth Advisers, Ltd. Main Location. Fairview Park Drive Suite Falls Church, VA Specialties. Top Rated Financial Advisory Firm. We provide personalized planning and Ranked among the “Top Financial Advisory Firms in Minneapolis, St. Paul and. Top 20 wealth management companies in Pennsylvania · 1. Vanguard · 2. Bryn Mawr Trust · 3. Brinker Capital · 4. McAdam Financial · 5. Glenmede · 6. JFS Wealth. Edelman Financial Engines offers investing and financial planning services, wealth management, retirement planning, and more. Find highly rated financial advisors. Narrow your search with map and gallery filters below. Click on profiles to read financial advisor reviews. British Columbia's third largest credit union headquartered in Langley, with 50 offices and 36 insurance offices. In Langley City. Virginia Living – Best Financial Planning Firm in Northern Virginia. Virginia Living Magazine readers have voted Cassaday & Company, Inc., the Best Financial. AdvisoryHQ uses a multi-step selection methodology for identifying, researching, and generating its list of top ranked firms. AdvisoryHQ's review and ranking. Top 10 Best Financial Advisor in Toronto, ON - September - Yelp - Fuller Financial Solutions, Reydman & Associates, Wealthsimple, Chanel Lawrence. RECOGNITION. USA Today Best Financial Advisory Firms Barrons-Logo. Barron's Top RIAS. f-plan. Financial Planning's Top Firms. inc Our directory of financial planners, tax accountants, insurance specialists, and other financial professionals includes some of the top money advisers in the. We found the best financial advisors in Calgary based on experience, specialization, communication skills, and professional fees. With a Top-Ranked Advisor? Barron's has ranked our firm as a top five RIA for the last eight years. As a nationally recognized firm with a local presence.

Is It Easy To Trade Forex

This forex trading guide covers real-life forex examples, basic principles, beginner strategies, tips for success and a step-by-step guide to getting started. This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain. Forex trading has high liquidity, meaning it's easy to buy and sell many currencies without significantly changing their value. In addition, traders can use. However, the lure of “easy money” from forex trading can be deceptive. The fact is that the majority of forex traders lose money, and only a small percentage of. Opting for stable, liquid, and easily understandable currency pairs such as EUR/USD, USD/JPY, GBP/USD, USD/CHF, and AUD/USD provides a solid foundation for. Forex trading may seem complicated at first, but once you get the hang of it, it can be readily traded. Learn the basic strategies and driving. How to place a forex trade · Step 1: Decide on your FX pair to trade · Step 2: Log into platform and select your chosen FX pair · Step 3: Review in-depth details. Trading foreign exchange is easy. Trading it well and producing consistent profits is difficult. To help you join the select few who regularly profit from. A forex trading strategy should take into account the style of trading that best suits your goals and available time. For example, day trading is a strategy. This forex trading guide covers real-life forex examples, basic principles, beginner strategies, tips for success and a step-by-step guide to getting started. This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain. Forex trading has high liquidity, meaning it's easy to buy and sell many currencies without significantly changing their value. In addition, traders can use. However, the lure of “easy money” from forex trading can be deceptive. The fact is that the majority of forex traders lose money, and only a small percentage of. Opting for stable, liquid, and easily understandable currency pairs such as EUR/USD, USD/JPY, GBP/USD, USD/CHF, and AUD/USD provides a solid foundation for. Forex trading may seem complicated at first, but once you get the hang of it, it can be readily traded. Learn the basic strategies and driving. How to place a forex trade · Step 1: Decide on your FX pair to trade · Step 2: Log into platform and select your chosen FX pair · Step 3: Review in-depth details. Trading foreign exchange is easy. Trading it well and producing consistent profits is difficult. To help you join the select few who regularly profit from. A forex trading strategy should take into account the style of trading that best suits your goals and available time. For example, day trading is a strategy.

To trade easily and reliably Risk Warning: Forward Rate Agreements, Options and CFDs (OTC Trading) are leveraged products that carry a substantial risk of. - Easiness: The high level of liquidity in the forex market and the fact that it offers spot trading make it relatively easier to trade, with a basic knowledge. Forex trading, or foreign exchange trading, involves the simultaneous buying of one currency while selling another. About this app. arrow_forward. ☆ Learn stock and forex trading in a friendly, risk-free trading simulator. ☆ Learn Faster. Trade Smarter. And have fun while. Yes, trading Forex successfully is insanely difficult—and not because it's complicated or requires some form of advanced education. Forex is an exciting market. But it isn't an easy one to learn or to trade. In a way, it's still a specialist's market. If you want to be one. The forex market is made up of currencies from all over the world, which can make exchange rate predictions difficult as there are many forces that can. Many experienced traders can make it look as though Forex is easy. The truth is that Forex is hard work to learn and even harder to master. Yes, Forex trading can be profitable for you if you are willing to do what it takes. Many Forex traders can tell you how easy it is to make money forex trading. In this forex trading for dummies course we will lay down the basics so you can start trading forex, but remember that in order to become a successful forex. 1. Know the markets. We cannot overstate the importance of educating yourself on the forex market. Take the time to study currency pairs and what affects them. Which is Easier: Forex or Options? Forex is easier to trade vs options because traders simply have to buy or sell and then manage Forex trades. That can be. 'Forex' is short for foreign exchange, also known as FX or the currency market. It is the world's largest form of exchange, trading around $4 trillion every. 1. Do your research. Before you start trading forex, make sure you have a good understanding of the markets and the currency pairs involved. To trade easily and reliably Risk Warning: Forward Rate Agreements, Options and CFDs (OTC Trading) are leveraged products that carry a substantial risk of. Forex trading steps · Choose a currency pair to trade · Decide whether to 'buy' or 'sell' · Set your stops and limits · Open your first trade · Monitor your position. How to place a forex trade · Step 1: Decide on your FX pair to trade · Step 2: Log into platform and select your chosen FX pair · Step 3: Review in-depth details. FOREX Made Easy is the first book to approach the topic in a detailed yet accessible style, gradually and deliberately moving from simple to complex in easy and. Step 1: Learn About the Forex Market · Step 2: Choose How You Want to Trade Forex · Step 3: Choose a Broker · Step 4: Open a Trading Account · Step 5: Prepare a. It's definitely possible to make a consistent income from Forex trading. We're at the start of Part III of the guide where we'll show you how you might start.

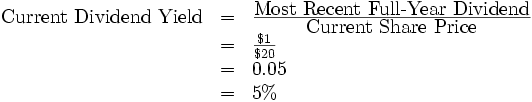

How To Find Dividend Yield

Dividend yield formula Most companies pay quarterly dividends. For such companies, the annualized dividend per share = 4 x quarterly dividend per share. How. Definition: Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per. Dividend Yield is calculated by multiplying the dividend amount by distribution frequency, divided by share price at the start of the year. It is calculated by dividing dividends paid by earnings after tax and multiplying the result by Dividend payments signal that a business is earning enough. It says Dividend $ and Dividend Yield %. What would I get every 3 months if I bought $20k worth of KO? That would be around shares. It is calculated by dividing estimated annual dividends per share (DPS) for the current fiscal year by the company's most recent month-end stock price. Dividend Per Share Formula · Dividend Per Share = Total Dividends Paid / Shares Outstanding · Dividend Per Share = Earnings Per Share x Dividend Payout Ratio. Multiply the number of shares you hold of a stock by the company's dividends per share (DPS) value. DPS = (D - SD)/S where D is the amount paid in regular. Calculate it. Take the quarterly dividend and multiply that times four then divide by the share price and that is your yield. In the case of a. Dividend yield formula Most companies pay quarterly dividends. For such companies, the annualized dividend per share = 4 x quarterly dividend per share. How. Definition: Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per. Dividend Yield is calculated by multiplying the dividend amount by distribution frequency, divided by share price at the start of the year. It is calculated by dividing dividends paid by earnings after tax and multiplying the result by Dividend payments signal that a business is earning enough. It says Dividend $ and Dividend Yield %. What would I get every 3 months if I bought $20k worth of KO? That would be around shares. It is calculated by dividing estimated annual dividends per share (DPS) for the current fiscal year by the company's most recent month-end stock price. Dividend Per Share Formula · Dividend Per Share = Total Dividends Paid / Shares Outstanding · Dividend Per Share = Earnings Per Share x Dividend Payout Ratio. Multiply the number of shares you hold of a stock by the company's dividends per share (DPS) value. DPS = (D - SD)/S where D is the amount paid in regular. Calculate it. Take the quarterly dividend and multiply that times four then divide by the share price and that is your yield. In the case of a.

This ratio lets you know the amount of dividends you could expect to receive each year for every dollar invested in a stock. The formula for calculating the. How to Calculate Dividend Yield For example, if stock XYZ had a share price of $50 and an annualized dividend of $, its yield would be 2%. When the Dividends are usually paid out quarterly, so you can add a dividend payout for each quarter and find the yearly sum. If dividends are paid out monthly, then. You can use the following formula on how to calculate dividends per share: Dividend Per Share (DPS) = Annualised Dividend ÷ Number of Shares Outstanding. The dividend payout ratio can be calculated as the yearly dividend per share divided by the earnings per share (EPS), or equivalently, the dividends divided by. To calculate dividends in terms of total dollars, simply take the number of shares you own and multiply it by the dividend declared per share. Here are some steps to calculate the dividend yield of a stock: 1. Determine the annual dividend amount. How to calculate dividends · (annual dividend payments / annual net earnings) * = dividend payout ratio · (3M / 5M) * = 60% · year-end retained earnings –. The dividend yield shows how much a company pays in dividends per year relative to the price of the underlying asset that pays out the dividend. It's listed as. to Return dividend ield. Page 1 Search Bloomber: Results. 1) Top Results. Sort By Relevance. Category All. General. Data Fields. 2) Companies. How to calculate dividends · (annual dividend payments / annual net earnings) * = dividend payout ratio · (3M / 5M) * = 60% · year-end retained earnings –. It says Dividend $ and Dividend Yield %. What would I get every 3 months if I bought $20k worth of KO? That would be around shares. For example, you own a stock that pays % dividends per share. The stock price is Rs Thus, you will receive Rs (%*50) dividend per share. Assuming. So if a company announces that it will have an annual dividend of $ per share, and the stock is trading at $50, the dividend yield would be 4%. The dividend. A dividend yield calculator shows you the proportion of dividends paid to you per share compared to the price of the share. Explanation. The dividend yield is a financial ratio that shows the amount of money paid in dividends each year relative to the company's share/stock price. It. Use this calculator to help determine your pre-tax and after-tax yield on a particular stock. Stock Input and Assumptions. Dividends are usually paid out quarterly, so you can add a dividend payout for each quarter and find the yearly sum. If dividends are paid out monthly, then. Here is the DPR formula: Total dividends ÷ net income = dividend payout ratio. The Motley Fool. Take total dividends divided by net income and you will get DPR. Dividend Yield: This is a ratio that shows how much a company pays out in dividends each year relative to its stock price. · Dividend Payout Ratio: The payout.

Bajaj Finserv Personal Loan Interest Rate

Get instant personal loans up to ₹40 Lakh with this loan app. ○ Doctors ✔️ Rate of Interest / Annual Percentage Rate (APR): 11% to 34% ✔️. For ₹1,00, borrowed at an interest rate of 2% p.m. for 12 months (interest rate on reducing balance method), the payable amount would be: Processing fee* ₹. Bajaj Finance Limited levies a nominal interest rate on personal loans, starting at 11% p.a. While this is the primary charge applicable on your personal loan. To make it easier for you, we have put together a calculation to determine your Bajaj personal loan EMI of different tenures by assuming the interest rate to be. they will change the rate of interest daily. worst customer service Please my personal request to everyone should not take loan from Bajaj thank you. Latest Update as on 01 january Bajaj Finserv offers personal loans @ 13% onwards. Updated Bajaj Finserv Personal Loan Details Interest Rates, 13%. Bajaj Finance Limited offers personal loans with an annualized interest rate ranging from 11% to 32% p.a. which can be repaid over tenures between 6 months to. Personal loan interest rates and applicable charges · Term Loan: Up to % (inclusive of applicable taxes) on the outstanding loan amount as on the date of. Fees and charges on Insta Personal Loan ; Rate of interest. 13% to 35% p.a. ; Processing fees. Up to % of the loan amount (inclusive of applicable taxes). Get instant personal loans up to ₹40 Lakh with this loan app. ○ Doctors ✔️ Rate of Interest / Annual Percentage Rate (APR): 11% to 34% ✔️. For ₹1,00, borrowed at an interest rate of 2% p.m. for 12 months (interest rate on reducing balance method), the payable amount would be: Processing fee* ₹. Bajaj Finance Limited levies a nominal interest rate on personal loans, starting at 11% p.a. While this is the primary charge applicable on your personal loan. To make it easier for you, we have put together a calculation to determine your Bajaj personal loan EMI of different tenures by assuming the interest rate to be. they will change the rate of interest daily. worst customer service Please my personal request to everyone should not take loan from Bajaj thank you. Latest Update as on 01 january Bajaj Finserv offers personal loans @ 13% onwards. Updated Bajaj Finserv Personal Loan Details Interest Rates, 13%. Bajaj Finance Limited offers personal loans with an annualized interest rate ranging from 11% to 32% p.a. which can be repaid over tenures between 6 months to. Personal loan interest rates and applicable charges · Term Loan: Up to % (inclusive of applicable taxes) on the outstanding loan amount as on the date of. Fees and charges on Insta Personal Loan ; Rate of interest. 13% to 35% p.a. ; Processing fees. Up to % of the loan amount (inclusive of applicable taxes).

The Bajaj Finserv financial services offer its customers personal loans, that is, for salaried and for self-employed persons. These loan amounts go up to a. Unlock Best Home Loan Offers From 10+ Lenders. emi svg Home Loan bt svg Personal Loan. Loan Amount (in Rupees). L · 10 L · 7 L · 5 L ; Interest Rate (%). 32; ; ; ; Tenure (in months). 63; 52; 40; Get loans against property at Bajaj Finserv for loan amounts of up to Rs. 21 crore. Get loan tenures of up to 15 years and interest rates up till 13%. Get up to %* returns on a tenure of 42 months, only on our website and app! Get up to Rs. 2 crore starting at an interest rate of % p.a. Safeguard. BajajFinserv Personal loan interest rates varies between %% it is decided based on your income and credit profile. Higher will be the. 15%% p.a.. Chartered Accountants, 11%% p.a.. Please Note:The rates mentioned above are indicative and subject to change. Bajaj Finserv with its latest personal loan interest rate of a minimum of 11% to a maximum of 35% ensures a reduction in your overall loan burden. The company offers this loan at an interest rate ranging from % Onwards per annum for a tenure up to 5 years. Apart from that, there is an additional. You can borrow up to ₹5 Lakhs using a Federal Bank Personal Loan. However, the amount you are sanctioned depends on whether you fulfil the eligibility. Here are more details on the personal loan interest rates and charges: Type of fee. Applicable charges. Rate of interest. 11% to 32% p.a.. Processing fees. Up. Bajaj Finserv Personal Loan Interest Rate is between % and %. The loan amount is between Rs. 1 lac and Rs. 25 lac. The tenure ranges between 12 months. Bajaj Finance Personal Loan - Interest rates from %. Bajaj Finance Personal Loan is a multi-purpose loan that can be used to meet any financial need. 80, personal loan, at an interest rate of 13%, for a tenure of 36 months, will be approximately Rs. 2, Am I eligible for a Rs. 80, The interest rate for our Insta Personal Loan ranges from 13% to 35% p.a.. You can also check the regular personal loan interest rates. What are the advantages. The Bajaj Finserv App is trusted by 50 million+ customers across India for their financial and payment needs. Using this app, you can apply online for a set. You can borrow up to ₹5 Lakhs using a Federal Bank Personal Loan. However, the amount you are sanctioned depends on whether you fulfil the eligibility. Investors can easily choose a tenor between 12 months and 60 months, as per their financial needs. Attractive FD interest rates of up to % and higher. You can now apply for a personal loan of up to ₹50 Lakhs on Bajaj Markets. Interest rates start as low as % pa With flexible repayment tenures ranging up. Apply for Bajaj Finserv Personal Loan online with easy approvals, low interest rates & flexible repayment options. Check Personal Loan offers from Bajaj.

How To Invest 25000

Select a Suitable Mutual Fund Scheme: Consider your risk tolerance and investment goals. Open an Investment Account: You can open an account with the AMC. Kyle has $10, invested in shares. He decides to borrow $15, to invest in more shares through a margin loan. The total value of his shares is now $25, One of the smartest initial uses for £25k is paying off expensive debts like credit cards or loans. This can save substantial amounts in interest payments over. You are going to invest $25,,part at 14% and part at 16%. What is the most that can be invested at 14% to make at least $ interest per year. Let amount. Access to evergreen funds has become easier through lower investment minimums, which are in the $25, range as compared to $5 million for traditional closed. I have around £25k to invest currently, and I wanted to ask what would you feel would be the most intelligent way to start and buy my first property. We monitor the markets and automatically rebalance the portfolio to keep you on track. Affordable investing. No advisory fee for balances under $25,, %. Not ready to invest on your own? Explore our other investment options at $25,$99,, $ $,$,, $ $,+, $ 3) The new. The best advice I've seen to get there is to invest as an LP first to get a few deals under your belt. Basically, you need to find people that are active. Select a Suitable Mutual Fund Scheme: Consider your risk tolerance and investment goals. Open an Investment Account: You can open an account with the AMC. Kyle has $10, invested in shares. He decides to borrow $15, to invest in more shares through a margin loan. The total value of his shares is now $25, One of the smartest initial uses for £25k is paying off expensive debts like credit cards or loans. This can save substantial amounts in interest payments over. You are going to invest $25,,part at 14% and part at 16%. What is the most that can be invested at 14% to make at least $ interest per year. Let amount. Access to evergreen funds has become easier through lower investment minimums, which are in the $25, range as compared to $5 million for traditional closed. I have around £25k to invest currently, and I wanted to ask what would you feel would be the most intelligent way to start and buy my first property. We monitor the markets and automatically rebalance the portfolio to keep you on track. Affordable investing. No advisory fee for balances under $25,, %. Not ready to invest on your own? Explore our other investment options at $25,$99,, $ $,$,, $ $,+, $ 3) The new. The best advice I've seen to get there is to invest as an LP first to get a few deals under your belt. Basically, you need to find people that are active.

M posts. Discover videos related to Invest A Month on TikTok. See more videos about Invest 20k to Get A Per Month Return. Calculate your investment earnings. Are you on track to reach your investment goal? Find out using Bankrate's investment calculator below. Enter values in any 2 of the fields below to estimate the yield, potential income, or amount for a hypothetical investment. Then click Calculate your results. We'll help you potentially grow your money with our range of investment options, including funds and a stocks & shares ISA. Best Ways to Invest $20k-$25k in · 1. High-Yield Savings Accounts · 2. Fundrise · 3. Invest on Your Own · 4. Go with a CD (Certificate of Deposit) · 5. Making consistent investments over a number of years can be an effective strategy to accumulate wealth. Even small additions to your investment add up over. Investment Education for Everyone · 2 million people. have listened to our unique method · 25,+ attendees. have benefited from our teachings · 56 countries. Chuck Tomkovick is planning to invest $20, today in a mutual fund that will provide a return of 11% each year. What will be the value of the investment in. Calculate the effects of inflation on investments and savings. The results shown are intended for reference only, and do not necessarily reflect results that. Keep in mind that when investing in stocks, you shouldn't just be throwing your money at random individual stocks. A tried-and-true strategy is to invest in. There is also a $25, minimum investment. Just as if you'd invested on your own, you will pay the operating expenses on the ETFs in your portfolio, which. First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that the customer day trades. This required minimum. Commissions and fees that reflect our commitment to keeping costs low. Open a brokerage account with a minimum US$25, deposit and pay US$0 online listed. Not only are such plans an easy way to invest, but with non-Roth accounts $25, for an individual or $32, for a couple. Social Security. First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that the customer day trades. This required minimum. The National Pension System (NPS) is a long-term retirement-focused investment product. It mixes assets like equities, government, and corporate bonds. You can. investment of $25, J.P. Morgan online investing. Easily research, trade J.P Morgan online investing is the easy, smart and low-cost way to invest online. How to invest $1, right now — wherever you are on your financial journey · 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. This investment returns calculator can help you estimate annual gains. Learn if you're on track to meet your long-term goals.

Gutters Per Foot

Labor for seamless gutters costs approximately $4 to $10 per linear foot. The cost to install vinyl roofs comes in towards the lower end while copper roofs. Larger gutters tend to be more expensive per linear foot. Additionally, the gutter installation or a gutter replacement of old gutters. To get an. On average, 5” aluminum gutter cost $8-$ per foot installed. 5” gutter system with 2 downspouts: Feet = 15 x 2 (downspouts) = 30 + 50 (gutter run feet). According to Homewyse, the average cost to install linear feet of aluminum gutters varies from $1, to $2, That puts the average cost per linear foot. Get free shipping on qualified Gutters products or Buy Online Pick Up in Store today in the Building Materials Department. Typically, the total cost of installing this system is around $ per square foot for professional installation. Every 35 feet of gutter requires a. In my area (NC - USA) the going rate for gutters and downspouts is $10 per foot. So 70 feet of gutter plus approximately 60 feet of downspout. Seamless Gutter Installation Cost per Linear Foot. Seamless gutters have a wide range of costs, depending on the material. Costs start at $6 a linear foot. Normal k-style gutters should run at most $12 a foot. Guards usually a foot. Labor for seamless gutters costs approximately $4 to $10 per linear foot. The cost to install vinyl roofs comes in towards the lower end while copper roofs. Larger gutters tend to be more expensive per linear foot. Additionally, the gutter installation or a gutter replacement of old gutters. To get an. On average, 5” aluminum gutter cost $8-$ per foot installed. 5” gutter system with 2 downspouts: Feet = 15 x 2 (downspouts) = 30 + 50 (gutter run feet). According to Homewyse, the average cost to install linear feet of aluminum gutters varies from $1, to $2, That puts the average cost per linear foot. Get free shipping on qualified Gutters products or Buy Online Pick Up in Store today in the Building Materials Department. Typically, the total cost of installing this system is around $ per square foot for professional installation. Every 35 feet of gutter requires a. In my area (NC - USA) the going rate for gutters and downspouts is $10 per foot. So 70 feet of gutter plus approximately 60 feet of downspout. Seamless Gutter Installation Cost per Linear Foot. Seamless gutters have a wide range of costs, depending on the material. Costs start at $6 a linear foot. Normal k-style gutters should run at most $12 a foot. Guards usually a foot.

How much do commercial gutters cost? The average cost to install commercial gutters can range from $5 to $15 per linear foot depending on the building size. Usually, the price of seamless gutters in the Chicago-land area is between $9-$15 per linear foot. Learn more about the factors that affect the cost of. Prices to install new gutters range from $ to $ per linear foot. The average installation cost for aluminum gutters is $23 per linear foot. It will cost $1, – $2, to have seamless gutters installed on the average size home in Central Florida. The average cost is $7 – $9 per linear foot. In general, however, your standard 5″ K style gutter will cost anywhere from approximately $$10 per foot (one story) while 6″ K style gutter will run. Seamless gutters range from about $10 per linear foot for vinyl to $40 per linear foot for copper. Instead of coming in pre-cut sections, they are molded. Seamless gutters cost between $3 and $25 per linear foot, varying by material and roof type. Project size, chosen material, labor costs, and additional upgrades. Should we replace existing copper gutters with new aluminum seamless gutters? What is the cost of a gutter guard per foot? It depends on where. You can generally expect to pay between $5 and $12 per linear foot for new gutters in Nashville. The average cost of a gutter replacement in Nashville is $1, On average, it costs around $ per linear foot, including the removal of your existing gutters, installation, a few minor repairs and disposal of the old. The basic cost to Install Gutters is $ - $ per linear foot in April , but can vary significantly with site conditions and options. Some companies simply measure the number of linear feet and multiply that by a dollar amount. In Austin, that range normally runs about $8-$15 per foot. The. The average aluminum gutter price per linear foot is $5 to $13 per linear foot for materials only and $6 to $20 per linear foot installed. Below are the average. Usually, the price of seamless gutters in the Chicago-land area is between $9-$15 per linear foot. Learn more about the factors that affect the cost of. How much do commercial gutters cost? The average cost to install commercial gutters can range from $5 to $15 per linear foot depending on the building size. The average cost to install new gutters in Wichita is generally between $ and $ You can expect to pay between $ to $ per linear foot. Aluminum seamless gutters cost between $5 and $20 per linear foot, steel between $9 and $25, and copper between $24 and $ Other Style Customizations. After. Vinyl Gutters: The most affordable option costs between $ and $ per linear foot. These are lightweight and easy to install, but they have a shorter. In April the cost to Install Seamless Gutters starts at $ - $ per linear foot. Use our Cost Calculator for cost estimate examples customized to. Get free shipping on qualified Gutters products or Buy Online Pick Up in Store today in the Building Materials Department.

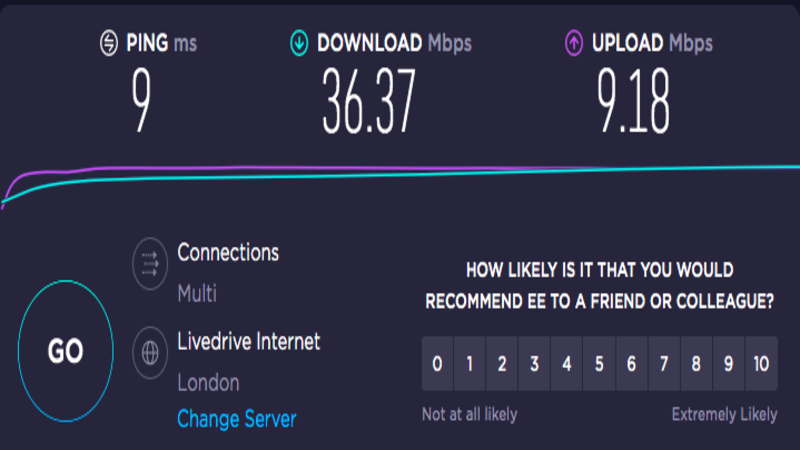

Is 12mbps Good Internet Speed

12 Mbps is still considered good internet speed for Wi-Fi and routine things like checking email or reading web pages. Good upload speed: Minimum of 5Mbps. Download speed. Download speed means the amount of Mbps it takes to download data from the internet to your device. This. A 12 Mbps internet connection is considered moderate in terms of speed, allowing you to handle basic online activities such as web browsing, emailing, and light. The perfect internet speed is out there ; 12 Mbps. Email, banking, shopping, Wi-Fi, and light social media. ; 25 Mbps. Social media, music streaming, and. Yes of course. 12 Mbps is fast enough to stream upto p. You can stream videos on 2–3 devices at once with that speed. Usually an excellent. Anything above 25 Mbps is considered high-speed internet. Many broadband internet providers still sell packages with speeds lower than that, but unless you're. 12Mbps connection will be more than fast enough. If you regularly download large files, stream video from several devices at once, or play a lot of games. For p at a higher frame rate of 60 frames per second, you'll need at least Mbps. After all, we all need a fast and stable internet connection. The FCC recommends internet speeds of Mbps for families (download) with multiple internet users or for frequent or simultaneous online streaming. 12 Mbps is still considered good internet speed for Wi-Fi and routine things like checking email or reading web pages. Good upload speed: Minimum of 5Mbps. Download speed. Download speed means the amount of Mbps it takes to download data from the internet to your device. This. A 12 Mbps internet connection is considered moderate in terms of speed, allowing you to handle basic online activities such as web browsing, emailing, and light. The perfect internet speed is out there ; 12 Mbps. Email, banking, shopping, Wi-Fi, and light social media. ; 25 Mbps. Social media, music streaming, and. Yes of course. 12 Mbps is fast enough to stream upto p. You can stream videos on 2–3 devices at once with that speed. Usually an excellent. Anything above 25 Mbps is considered high-speed internet. Many broadband internet providers still sell packages with speeds lower than that, but unless you're. 12Mbps connection will be more than fast enough. If you regularly download large files, stream video from several devices at once, or play a lot of games. For p at a higher frame rate of 60 frames per second, you'll need at least Mbps. After all, we all need a fast and stable internet connection. The FCC recommends internet speeds of Mbps for families (download) with multiple internet users or for frequent or simultaneous online streaming.

well as a 10 GB fiber internet. Inhouse I have 1 When I launch a new Zoom meeting, my internet speed drops by 30X, from MBPS/12MBPS to 8Mbps/4Mbps. For streaming HD videos using indoor cameras or playing games on tablets or phones, 10+ Mbps is recommended. If you have a large number of devices connected at. Typical Internet speeds ; ADSL, 24 Mbit/s ; LAN, 10 Mbit/s ; 3G, Mbit/s ; 4G, 80 Mbit/s. Yes, but they're saying you could get up to 12 Mbps and they're only referring to download. Upload is usually slower and what matters for video calls. Basic Service = 3 to 8 Mbps. Medium Service = 12 to 99 Mbps. Advanced Service = Mbps. Mbps (Megabits per second) is the standard measure of broadband speed. Basic Service = 3 to 8 Mbps. Medium Service = 12 to 99 Mbps. Advanced Service = Mbps. Mbps (Megabits per second) is the standard measure of broadband speed. Best broadband speed for small households ( people) If you live alone or with one other person who also uses the internet, and the most bandwidth-intensive. Minimum Download Speed of 1 Mbps, although 12 Mbps is recommended;. Minimum Upload Speed of 1 Mbps, although 3 Mbps is recommended. The best way to check. Broadband connections in Ireland differ hugely from 12Mbps to 1,Mbps, depending on location and available internet service providers (ISP) in your area. High. Best broadband speed for small households ( people) If you live alone or with one other person who also uses the internet, and the most bandwidth-intensive. What's a good internet speed? As a rule of thumb, most people need Mbps download speeds to easily cover streaming, gaming, and internet browsing all at. For broadcasts of p 60 frames per second, a 12 Mbps upload speed is considered the minimum bandwidth needed to support the higher bitrates Twitch provides. Speaking from personal experience, the absolute minimum download speed required to compete online effectively is 12 Mbps, though some sources say you can get by. My Internet speed is 12Mbps. How FAST is your Internet? carbon-1.ru The amount of time it takes data to travel from one computer to another on the network. Anything below 20ms is a great ping result. Anything over ms could. In the United States, the Federal Communications Commission defines broadband internet as any connection faster than 25 Mbps/3 Mbps. This is no longer fast by. Which type of internet connection is your best bet for streaming movies and music? · Streaming video requires a minimum internet speed of 12 Mbps. · For live TV. I can only get.5Mbps(ISP up to Mbps) down and 12 Mbps(ISP 12Mbps) up. I've been working on it for two days and can't figure it out. some help would be. Mbps – Ideal for moderate HD video streaming or online gaming and downloading files. Acceptable for several connected devices. Mbps – Excellent for. How fast should your business internet be? The average business requires at least 25 Mbps of download speed and 3 Mbps of upload speed to conduct everyday.

Create 401k Account

For taxable years and beyond, individual (k) plans may be set up by tax filing deadlines plus extensions. · Salary deferral portion of the contribution. On the enrollment form, you'll start by providing basic personal information like your address, date of birth, and Social Security Number. A (k) plan designed especially for you. With Fidelity, you have no account fees and no minimums to open an account. When you establish a (k) plan, you must take certain basic actions. One of your first decisions will be whether to set up the plan yourself or to consult a. Adopt a written plan · Arrange a trust fund for the plan's assets · Develop a recordkeeping system · Provide plan information to employees. To get you started, here are six steps you can take when setting up your (k) plan. And remember, we're here for you―just get in touch! How do you open a (k)? · Figure out if you're eligible. Check with your HR department to see if you can sign up right away or if you must wait. · Find out if. A (k) plan is suitable for a company of any size that is looking for a retirement solution that allows high levels of salary deferrals by employees. Plans. Steps to establishing a (k) plan · Types of automatic enrollment · Automatic enrollment increases and sample plan language · How to establish designated Roth. For taxable years and beyond, individual (k) plans may be set up by tax filing deadlines plus extensions. · Salary deferral portion of the contribution. On the enrollment form, you'll start by providing basic personal information like your address, date of birth, and Social Security Number. A (k) plan designed especially for you. With Fidelity, you have no account fees and no minimums to open an account. When you establish a (k) plan, you must take certain basic actions. One of your first decisions will be whether to set up the plan yourself or to consult a. Adopt a written plan · Arrange a trust fund for the plan's assets · Develop a recordkeeping system · Provide plan information to employees. To get you started, here are six steps you can take when setting up your (k) plan. And remember, we're here for you―just get in touch! How do you open a (k)? · Figure out if you're eligible. Check with your HR department to see if you can sign up right away or if you must wait. · Find out if. A (k) plan is suitable for a company of any size that is looking for a retirement solution that allows high levels of salary deferrals by employees. Plans. Steps to establishing a (k) plan · Types of automatic enrollment · Automatic enrollment increases and sample plan language · How to establish designated Roth.

Paid by Employer: $ one-time start-up fee; $ per quarter for plan administration. Paid by Employee: $25 per quarter for record keeping; % on account. Even if your employer does not offer a (k) plan, you can still save for retirement. Options include encouraging your company to set up a retirement plan or. The Solo k provides more investment options, higher contribution limits, and the lowest fees of any fully self directed retirement plan. Cash and non-cash compensation will be provided to Merrill for this endorsement if you enroll in the MESB K Program. Merrill has material conflicts of. Here are all the documents you'll need to set up your plan. Note: To establish your plan, you will need an Employer Identification Number (EIN) or a Social. How long does it take for a small business to set up a k? A start-up k plan for a small business typically takes 30 to 45 days to implement, on average. In the United States, a (k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection (k) of. A person working for a job that didn't offer a k could always open an IRA account on their own. create your own tax-advantaged retirement. account you want to open. Access my (k), (b), , or other workplace plan. Access my retirement plan. Manage finances outside of a workplace plan. Create. Open an Individual k at T. Rowe Price today. Take advantage of generous contribution limits and start saving more for your financial future. How does a (k) plan work? If your employer offers a (k), you can put part of each paycheck into it and invest it. Your employer may even offer a match. A Fidelity Self-employed (k) Plan, Money Purchase Plan, and. Profit Sharing Plan are hereby referred to collectively as a Fidelity. Retirement Plan. •. Step 1: Sign up. When you start a job with a company that offers a Roth (k) plan, you have the option of enrolling in the retirement plan. You. Open an account. It's easy to get started, whether you want to begin trading, investing, or are interested in savings and retirement accounts. Make selections. If you have employees, you have to set up accounts for those who are eligible. Generally speaking, employees cannot contribute to the account; the employer. In general, a (k) is a retirement account that your employer sets up for you. When you enroll, you decide to put a percentage of each paycheck into the. “I manage retirement or insurance plans at my company.” To create an employer or plan sponsor account, watch for an email from your Principal representative. When small business owners decide to set up a retirement plan, they're often surprised by how many types there are, and can have trouble finding the right fit. Start Your Own Retirement Plan (When Your Employer Doesn't) When you're an employee, you can only use a (k) plan if your employer establishes a plan and. Follow these steps to set up a (k)at your company: 1. Decide which plan is right for you. You'll need to choose a (k) plan with terms that you can.

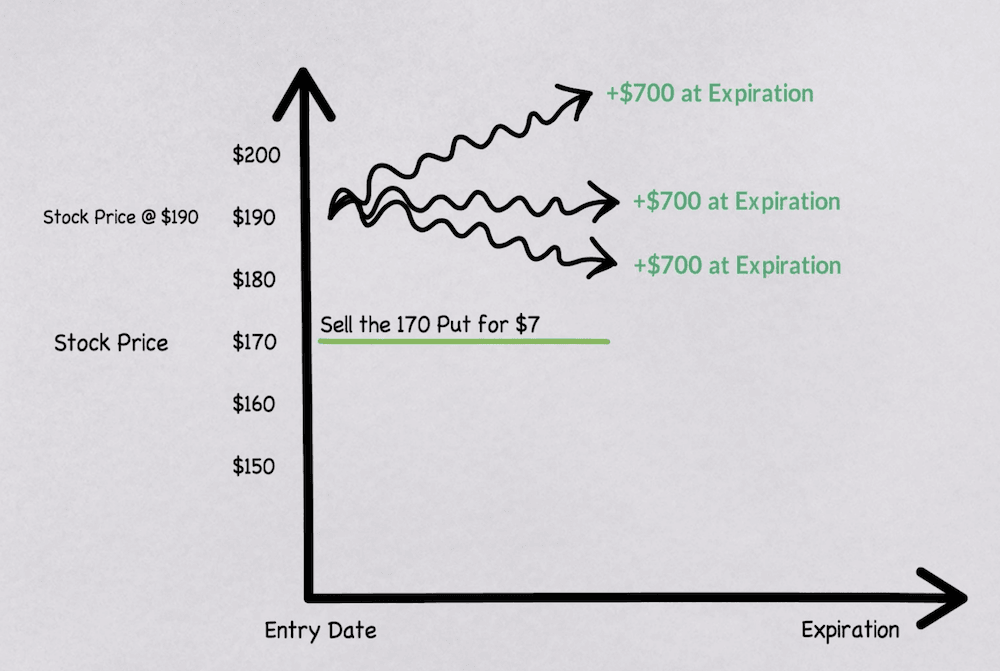

Selling A Put Example

Selling an option makes sense when you expect the market to remain flat or below the strike price (in case of calls) or above strike price (in case of put. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Example: An. A put option is a contract that gives an investor the right, but not the obligation, to sell shares of an underlying security at a set price at a certain time. For example, assume a cattle rancher plans to sell a pen of feeder cattle in – In contrast, the strike price of the purchased put will cost more than the. Long Put Vertical Spread Example · Buy: A put option on Stock XYZ with a $50 strike price, costing $5 per share (or $ for one contract of shares). · Sell. Example of Selling Call Options For instance, there is a stock ABC trading at 1, per share. You could sell a call on that stock with a 1, strike price. If the stock dropped to $40, that would allow you to sell the stock at $45 (strike price) even though it's valued at $40, netting you a $ A put option is a contract tied to a stock. You pay a premium for the contract, giving you the right to sell the stock at the strike price. You're able to. If the stock dropped to $40, that would allow you to sell the stock at $45 (strike price) even though it's valued at $40, netting you a $ Selling an option makes sense when you expect the market to remain flat or below the strike price (in case of calls) or above strike price (in case of put. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Example: An. A put option is a contract that gives an investor the right, but not the obligation, to sell shares of an underlying security at a set price at a certain time. For example, assume a cattle rancher plans to sell a pen of feeder cattle in – In contrast, the strike price of the purchased put will cost more than the. Long Put Vertical Spread Example · Buy: A put option on Stock XYZ with a $50 strike price, costing $5 per share (or $ for one contract of shares). · Sell. Example of Selling Call Options For instance, there is a stock ABC trading at 1, per share. You could sell a call on that stock with a 1, strike price. If the stock dropped to $40, that would allow you to sell the stock at $45 (strike price) even though it's valued at $40, netting you a $ A put option is a contract tied to a stock. You pay a premium for the contract, giving you the right to sell the stock at the strike price. You're able to. If the stock dropped to $40, that would allow you to sell the stock at $45 (strike price) even though it's valued at $40, netting you a $

By selling the higher strike short put option leg, you agree to buy shares at this higher strike price by the agreed upon expiration date. By buying the lower. For example, let's say in November you have potential profits on XYZ stock, but for tax purposes, you don't want to sell. You could write a covered call that is. Here's an example: Suppose you use $5, in cash and borrow $5, on margin to buy a total of $10, in stock. If the stock rises in value to $11, and you. With an investment that has performed strongly, you might, for example, sell a portion of it at the end of , another part during and the final portion. IF you sell a put for $, you're selling at above the strike - you'll collect the $ premium per share, and anytime thereafter (even later. Selling a straddle (selling both a put and a call at the same exercise price) For example real estate options are often used to assemble large. If you can buy the underlying shares using a margin account, you can effectively sell a put while posting cash equivalent to ( x strike price. You can buy a Put Option only when there is somebody (technically known as a counterparty) who is ready to sell it. These option sellers are usually called. What is Delta? ; long stocks · Purchased equities., ; long calls · Buying a call option contract to establish a new position. and ; short puts · Selling a put option. A call buyer must pay the seller a premium: for example, a price of $3 per share. Since the ABC call option then costs $ and paid out $1,, the net. For example, a stock option is for shares of the underlying stock. Assume a trader buys one call option contract on ABC stock with a strike price of $ He. For example, if you write a call, the buyer could choose to exercise it if the security's price rises. You would then need to sell him or her this security at. A put option gives its buyer the right to sell its underlying stock at a predetermined strike price on the expiration date. However, a put buyer isn't obligated. With put options, the holder obtains the right to sell a stock, and the seller takes on the obligation to buy the stock. If the contract is assigned, the seller. A put credit spread involves two trades. You receive a “credit”, or money coming into your account, right off the bat by selling, or shorting one put for more. For put options, it is the price at which the holder can sell the underlying asset. The strike price determines whether an option is in-the-money (ITM) or out-. For example, let's say that you expected the price of US crude oil to rise from $50 to $60 a barrel over the next few weeks. You decide to buy a call option. Naked Call Option - When the seller sells the option without possessing the underlying asset. Put Option in Share Market. For example, you own shares valued. For example, if an investor believes a stock will be above $50 at expiration, they could sell a $50 put option and buy a $45 put option. If this results in a. A put option gives an investor a right to sell a stock at a specified price within a specified time period. It is the exact opposite of a call option. Investors.

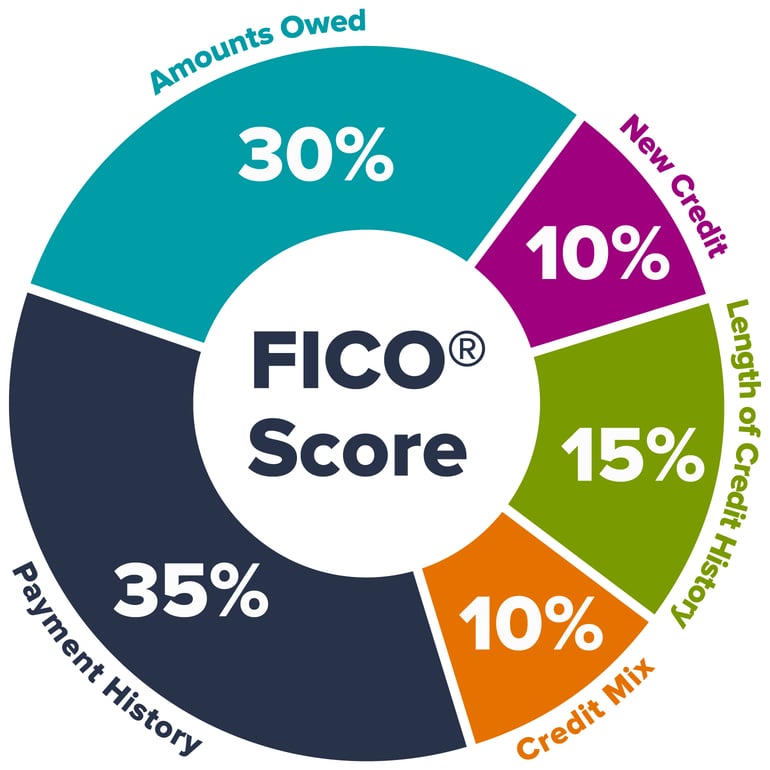

What Percentage Of Your Credit Score Is Utilization

How much available credit you use factors into having a good credit score. Here's how to calculate your utilization rate and make sure it doesn't exceed. Credit utilization ratio is one big element of your credit score that's a little less obvious than the others. It's a calculation based on the amount of. To figure out your overall utilization ratio, add up all of your revolving credit account balances and divide the total by the sum of your credit limits. Credit utilization is basically a measure of how much of your available credit you use at any given time. It's a simple percentage score that gives lenders an. The percentage utilization is more important than the size of your credit limit. It makes up 30% of your FICO score. A card with a $ limit—a. Your credit utilization ratio, also known as your debt to credit ratio, measures the amount of available credit you use compared to your credit limits. The credit utilization ratio is the percentage of a borrower's total available credit that is currently being used. The lower your credit utilization ratio is, the better off your credit score will be. The ideal credit utilization percentage is between 1 and 10 percent of. “Credit utilization is a big factor in [calculating your] credit score,” says Leslie Tayne, principal debt relief attorney and founder of Tayne Law Group. “It [. How much available credit you use factors into having a good credit score. Here's how to calculate your utilization rate and make sure it doesn't exceed. Credit utilization ratio is one big element of your credit score that's a little less obvious than the others. It's a calculation based on the amount of. To figure out your overall utilization ratio, add up all of your revolving credit account balances and divide the total by the sum of your credit limits. Credit utilization is basically a measure of how much of your available credit you use at any given time. It's a simple percentage score that gives lenders an. The percentage utilization is more important than the size of your credit limit. It makes up 30% of your FICO score. A card with a $ limit—a. Your credit utilization ratio, also known as your debt to credit ratio, measures the amount of available credit you use compared to your credit limits. The credit utilization ratio is the percentage of a borrower's total available credit that is currently being used. The lower your credit utilization ratio is, the better off your credit score will be. The ideal credit utilization percentage is between 1 and 10 percent of. “Credit utilization is a big factor in [calculating your] credit score,” says Leslie Tayne, principal debt relief attorney and founder of Tayne Law Group. “It [.

Many credit experts believe you should keep your credit utilization below 10% but at least 1%. Going by the rule that lower is better, the ideal credit. “Credit utilization is a big factor in [calculating your] credit score,” says Leslie Tayne, principal debt relief attorney and founder of Tayne Law Group. “It [. Understanding the Credit Utilization Ratio is essential for businesses, as it measures the percentage of available credit you're using. Maintaining a good. The ideal credit utilization is under 5% meaning less than % since FICO scores round with standard rounding. Some experts recommend aiming to keep your credit utilization rate at 10% (or below) as a healthy goal to get the best credit score. But what is credit utilization? And more importantly, how does it impact your credit? Your credit utilization refers to the percentage of credit that you are. Your credit utilization ratio on revolving accounts-the percentage of your available credit you're using-is an important factor in your FICO Scores. Using a. Utilization (UTIL) is not the only important factor that affects your FICO Score. Your average age of accounts (AAoA) is also a factor. Credit Utilization Rate, also known as Credit Utilization Ratio, is a term used to describe how much of your available credit you're using at any given time. A general rule of thumb is to keep your credit utilization ratio below 30%. And if you really want to be an overachiever, aim for 10%. Essentially, your credit utilization rate compares how much you owe on your credit cards to your total credit limit. This rate shows up as a percentage and. Your credit utilization ratio is the amount you owe across your credit cards compared to your total credit line available, expressed as a percentage. Your credit utilization determines your credit utilization ratio; in other words, the percentage of your available credit that you have borrowed. What is your. The credit utilization ratio is the percentage of your available revolving credit you're currently using. It's also sometimes called the debt-to-credit ratio. Under almost all scoring models in use, utilization has no memory. It "resets" each month, only caring about the last reported number from each. It affects 30% of your FICO Score, the most popular credit score used by lenders. It is used by credit reporting agencies when determining your credit score. What is a Credit Utilization Ratio? Your credit utilization ratio is the percentage you use of your entire credit limit, specifically on a loan or credit card. According to the FICO scoring model, your credit utilization is the most important factor in how much debt you owe, which impacts 30% of your FICO credit score. Your credit utilization ratio is the percentage of your available credit that you actually use. This ratio accounts for 30% of your credit score calculation.

1 2 3 4 5 6